Leading Non-Bank Lender

MAGC provides a diverse range of small business loan options and is excited to learn about new opportunities of any size, but most transactions fall within these parameters:

- Average Loan: $1.2 million

- Typical Loan Size Range: $500,000 to $10 million

- Company Revenue: $1 million to $100 million

Niche

- Borrowers who don’t meet traditional bank requirements

- Growth companies with adequate cash flow but limited collateral

- Rural markets

Loan Types

- Long-term working capital to support growth

- Acquisition or change of control

- Equipment or real estate purchase

- Debt refinance

Terms

- Up to 30 years

- Fully amortizing

- Typically Prime Rate +3%

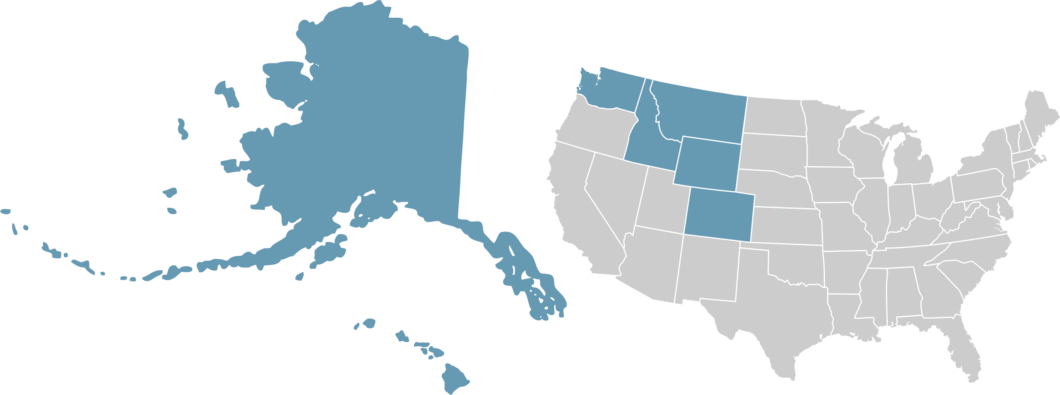

Where We Do Business

Through its over 20-year history, McKinley Alaska Growth Capital has expanded into markets that have demonstrated a need for a lender that can act quickly and provide capital for companies that may have a hard time obtaining, or are not yet ready for, traditional bank financing. MAGC is currently doing business in Alaska, Montana, Hawaii, Idaho, Washington and Colorado; providing SBA and USDA loans to small businesses in Alaska and USDA loans to small businesses across our northwest markets.

Loan Programs

SBA

- Approved to offer SBA loan products under SBA’s Preferred Lenders Program

- AGC partner since 1998

- 7(a) Loan Guarantee Program up to $5 million

- AGC is a Preferred Lender, and 9-time Community Lender of the Year

- Visit SBA Online

USDA

- AGC partner since 1998

- Business & Industrial Loan Guarantee program available for qualifying rural businesses

- AGC staff expertise and options for larger loans

- Visit USDA Online

Additional Resources

Alaska Small Business Development Center (AKSBDC)